The tax called Motor Vehicles Tax (MTV) is the tax that must be paid by all motor land vehicles, helicopters and planes registered and registered, and registered and registered motor sea vehicles according to the Highway Traffic Law. What Happens If MTV Is Paid Late? MTV What ZamThe moment is paid? What Happens If MTV Isn't Paid? How is MTV Paid? 2023 MTV Calculator.

What is MTV?

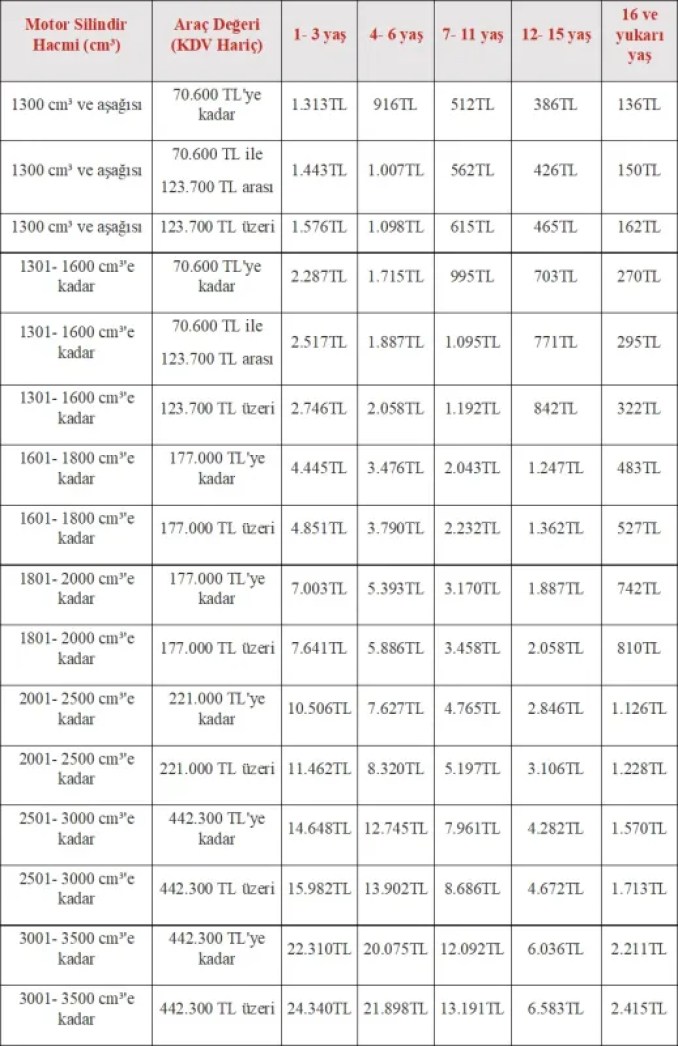

The type of vehicle, vehicle value, age and other features are taken into account in the calculation of MTV. Vehicle value is what remains after expenses are deducted from earnings to determine the tax amount. Cars and motorcycles are calculated based on their age and cylinder volume, buses are based on seating capacity and age, and trucks are based on age and size.zami is calculated based on the total weight.

Motor vehicle tax is paid to the tax office or through contracted banks and the website of the Revenue Administration. Many people may want to pay via internet banking, but it should be noted that e-receipts do not replace receipts. In this case, vehicle owners must obtain a collection receipt from the bank branch after making the MTV payment.

2023 MTV Prices

For Cars Purchased Before 01/01/2018:

For Cars Purchased After 01/01/2018:

MTV Prices for Motorcycles:

2023 MTV Calculation

As of January 1, 2023, MTV amounts have been announced with an increase of 61,5%. This decision is a result of the new decision taken in December 2022. 2022 MTV calculations were also calculated with a 25% increase compared to the previous year.

How is MTV Paid?

You can pay for Motor Vehicle Tax through many different channels. MTV payment transactions can be made through the official website of the Revenue Administration, as well as via the Internet branch of the Banks or mobile banking.

If the payment is made online and the collection document will be used in official transactions, this document must be printed out. In order for the document to be official, it must be approved by the tax office after the transaction.

What Happens If MTV Is Paid Late?

In case of late tax, if there is a delay in the first installment of the year, the second installment is collected in bulk. If the MTV is not paid for any reason, interest starts to accrue on the amount. A monthly 2,5% interest is charged on the amount to be paid. If payment is not made for a long period of time, the Ministry of Finance takes action and sends a warning letter to the debt payer. This letter carries an official notice to remind you to pay. If no payment is made as a result of this warning, the taxpayer's bank accounts may be confiscated.

MTV What ZamThe moment is paid?

MTV registration must be paid immediately after registration begins. MTV is paid in two installments in January and July.

What Happens If MTV Isn't Paid?

MTV is a compulsory tax type. All registered vehicle owners are obliged to make regular annual MTV payments. If MTV is not paid, bank accounts may be confiscated and judicial proceedings may be initiated for indebtedness to the state.